Sep 14 2012

The $1 Million Problem – Temporary or Ongoing?

Piedmont schools face a $1 million deficit in 2013-14. The hope has been that recent Piedmont school financial shortfalls

Prior to 2009, Piedmont school revenues grew every year,

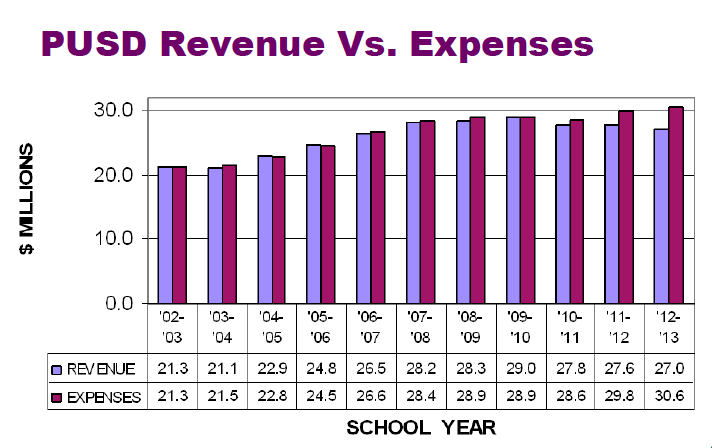

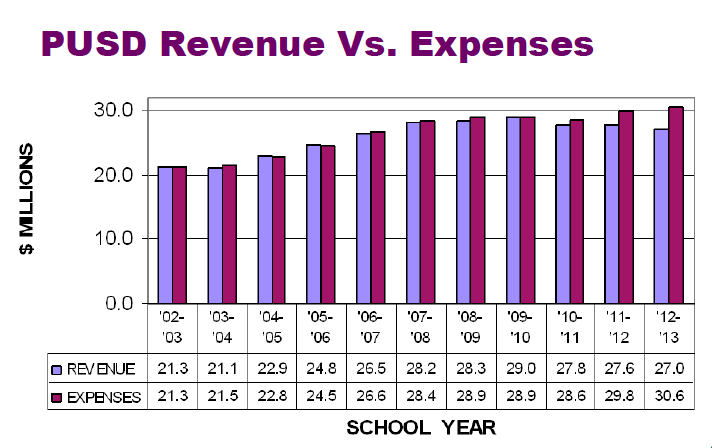

Between 2002 & 201o, expenses rose from $20 million to almost $30 million, according to the Budget Advisory Committee chart (shown below).

Parcel Taxes Rise to Cover a Growing Gap

Faced with growing expenses, the Piedmont Board of Education requested a substantial increase in school parcel tax rates from voters in 2006. In 2009, a sudden reduction in state revenue led to another request to increase

(The figures shown below do not include bond assessments, which are separate levies. See How do School Bond assessments fit into the picture (updated). Ranges reflect the minimum and maximum levy, based on parcel size.)

- 2006 base parcel taxes approved by voters in 2005 (Measures B & C: $1559-$2647

- 2006/07 – maximum 5% imposed by School Board: $1559-$2647

- 2007/08 – maximum 5% imposed by School Board: $1637-$2779

- 2008/09 – maximum 5% imposed by School Board: $1719-$2918

- 2009/10 – maximum 5% increase imposed by School Board: $1804-$3064

- 2009 flat temporary emergency tax approved by voters for 3 years (Measure E)

- $219 to $372 from 2009/10 to 2011/12 – no increases permitted

In 2009, Measure B & E supporters argued an increased emergency parcel tax was necessary to offset state revenue reductions, and Measure B taxes would not increase. Opponents objected that parcel tax increases were funding uncontrolled spending growth in addition to making up for

“While the district faces a cut in state funding (equaling about 3% of the budget), total income will be about the same next year. The real problem is an uncontrolled budget. In the last three years, spending has increased by about $5 million, or about 20%. The average annual increase has been over 6% or about $1.6 million. The problem is historic. In this decade, employee compensation has gone up by almost 60% + in some individual years as much as 9% to 11%. To cover these extraordinary increases the district has more than tripled the parcel taxes.” (See here; emphasis added.)

The 2009 Measure B campaign literature emphasized there would be “no increase in your taxes.” However, the Measure B guarantee of no increase applied only to the first year of the measure and did not extend to future years. Measure B also combined the prior 2005 voter-approved parcel taxes (Measures B & C)

Measure B was approved, as well as Measure E, a temporary emergency flat tax of $1 million for a period of 3 years, to bridge state revenue reductions.

The 2009 vote by residents was significant in 3 ways. First, the voters ratified past annual increases imposed by the School Board. Second, voters did not provide a mandate for future Measure B levies above the 2009 level (since the campaign was based on the assertion “your taxes will not be increased.”) Third, approval of the 2009 rate was followed by a February 1, 2010 Citizens’ Advisory Committee Report which noted adjustments to school programs and personnel were still required to increase cost efficiency – adjustments to create a stable “long-term financial plan” first requested by the School Board in 2006.

Read More in this series of articles examining Piedmont School Finances: