OPINION: Property Transfer Tax Revenue Underestimated in Budgets

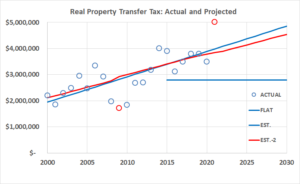

Y = mX + b. That’s not a typo but an equation, instantly recognizable to mathematicians as the equation for linear regression. Put technically, the known value (X) times the slope (m) plus a fudge factor (b) estimates the unknown value (Y). Put simply, estimate the unknown future value from the known past values..In the figure below, X, the horizontal axis, is years (2000-2030) and Y, the vertical axis, is the annual Real Property Transfer tax revenue in dollars (millions), collected on Piedmont home sales from 2000 to 2021. The circles show the annual tax revenue and the blue line is the linear regression of that data out to the year 2030..Because linear regression is not perfect, to be safe, practitioners will take out the high and low values (outliers) and re-run the regression. The red line shows the estimated tax revenue with the two red circles removed from the regression..The 2009 data is the Great Recession when the tax revenue was $1.7M and the 2021 data is this year’s tax revenue (The COVID bubble?), likely to be $5M. The lines pretty much overlay each other and show a very consistent increase in tax revenue over 20 years, with or without the outliers.Every year, rather than rely on linear regression to estimate end of the year tax revenue, the City simply assumes revenue will be $2.8M. And every year, the city winds up with $500,000 or more to put away into reserve funds like Facility Maintenance, Equipment Replacement or Pension Stabilization.

This year is an exception– almost a $2M surplus will be collected. On a year-to-year basis, that may be ok – by staying on budget the city ends the year with a surplus that can be banked for long term needs.

But last year the City decided to project this $2.8 forward for 10 years – that’s the flat line in the figure – and claimed the city was facing a “deficit”. This reasoning was offered as justification for putting Measure TT, the proposed increase in the transfer tax, on the 2020 ballot. Measure TT failed, just in time for record transfer tax revenues.

Why this all matters is because the Budget Advisory and Financial Planning Committee (BAFPC) will soon convene and possibly consider what to do about the failure of TT.

The BAFPC reviews the revenue projections by staff and there’s chatter of a “Plan B” to raise more revenue. Perhaps with a new Mayor and chairperson there will be new thinking by the BAFPC and the committee will advise staff to adopt a more accurate forecasting approach.

For example, transfer tax receipts over the past 10 years now average $3.4M annually (not including 2021) – use that value for the flat-line projection. Better yet, perform this simple linear regression to project next year’s revenue and apportion that estimate to the three funds as needed. The BAFPC needs to get the revenue projections right before it starts considering new taxes.

Garrett Keating, Former City Council Member

Garrett, just think how flush the city would be if Measure TT had passed. As I recall, it was about a 30% increase. In defense of the city, it is hard to forecast future rises in home values, and the annual rate of sales.

I accept that there is some uncertainty in future transfer tax collections. Garrett may well be right, though I have been skeptical of ever-increasing property prices for about 20 years, and been wrong most of the time. My disagreement with increasing the transfer tax is more fundamental. The City needs to update its infrastructure. That infrastructure benefits everyone who lives here. Imposing higher burdens on newcomers–both increased transfer taxes as well as a much higher tax base–than on all taxpayers is unfair. Being a longtime homeowners is not a ticket to avoid paying our fair share of the costs of living in a wonderful community. A parcel tax, perhaps with some gradations approximated to ability to pay (though none will be perfect) is the fairest approach.

My recollection is that Measure TT was to raise $900,000, as Mike says, 30% of the estimated $2.8M. Based on the past 10 year average of $3.4M, current annual tax revenue brings in $600,000, 21% of the 2.8 estimate. Mike has a point about forecasting but at the very least the Transfer tax projections need to be adjusted so the city can conduct accurate financial planning.

Rick raises an interesting equity question that is unlikely to be taken up by the BAFPC. Besides the tax increase, the last BAFPC recommended that the city and school district consult on future tax increases – perhaps that discussion will address Rick’s point.