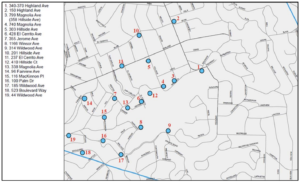

NOTICE IS HEREBY GIVEN that at 5:30 p.m. on Tuesday, October 29, 2019, the Piedmont Planning Commission, City Hall, 120 Vista Avenue, will consider applications for Wireless Communication Facilities permits submitted by Crown Castle NG West LLC and Suresite Development, each application with project number #19-0188. The Commission will consider applications for sites 10 to 18.

Click on map for enlargement.

By October 11, 2019, all power had been restored to Piedmont properties. Many Piedmonters did not see the need for the shut off, others who had endured devastating fires in the past welcomed the precaution. Most of Piedmont did not have a loss of power. Properties at a higher elevation were impacted by the shut off.

Some vigorous complaints came from those not losing power. Their electricity was on, but Comcast/ Xfinity services were off – no television, internet, or phones. Comcast offered no explanation as to why their service was eliminated in areas that continued to have power.

The power shut off event provided a significant indication of what could happen during a major earthquake or other emergencies. Piedmonters filled their bathtubs with water, readied their grab and go bags, and found ways to light the darkness.

HELP FOR ALL PIEDMONTERS

Piedmont’s Emergency Preparedness Committee has produced an extremely useful brochure, Get Ready! Piedmont, to inform Piedmonters about advantageous actions related to emergencies.

The handbook is linked below and can also be obtained in hard copy through the Piedmont Fire Department.

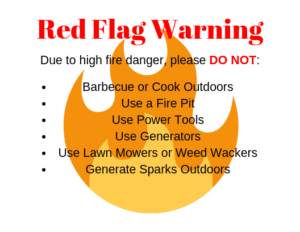

As of October 8, 2019, the entire City of Piedmont is under a RED FLAG WARNING along with a large portion of the state.

CalFire has implemented a burn ban for our area.

Piedmont Police and Fire Departments will be patrolling the community enforcing the burn ban and to ensure roads are kept clear during this event. Please park your vehicles in your driveway to keep the roads clear.

[Those who park their vehicles in a garage with an electrified garage door may not be able to open their garage door if the power is off. Suggestions have been made to either leave the garage door open or park vehicles outside of the garage to allow full use of the vehicles.]

October 8th is the anniversary of the Tubbs Fire in 2017 which decimated Napa, Sonoma, and Lake Counties, inflicting the greatest damage on the City of Santa Rosa. It was the most destructive wildfire in California’s history, until the Camp Fire. We face similar fire conditions in the next few days here in Piedmont; strong winds will combine with warm, dry air blowing from the north.

Please remain vigilant for these hazards:

- If you see smoke or fire LEAVE THE AREA and call 911. DO NOT wait to be evacuated. Keep some basic supplies in your vehicle, so you can leave immediately if you feel threatened.

- PG&E has announced a preemptive Public Safety Power Shutoff due to the wind. Piedmont has several areas within the affected zones. You should be prepared for extended power disruption, up to 5 days. Visit PGE.com for details on affected neighborhoods or call 866-743-6589.

- The wind will be a major safety hazard causing damage to trees and utility infrastructure. There will likely be additional unplanned power disruptions. We are asking all Piedmont residents to be aware of your surroundings while driving or walking in our town. You should look for leaning or broken trees or power poles and avoid the area. Traffic signals could also be impacted and drivers need to treat these intersections as a four-way stop if the traffic signal is out.

The Piedmont Fire, Police, and Public Works Departments have additional emergency personnel on duty and will be in a heightened state of readiness during this event. The wind is expected to subside late on Thursday, October 10th. Power disruptions could be protracted depending on the degree of damage to PG&E utilities.

Please visit our City of Piedmont website for more information. Keep in mind when the power is disrupted your internet may not work….so DON’T WAIT. This is also a great time to update your family’s disaster preparedness. Please look at this list for guidance.

Piedmont’s Emergency Preparedness Booklet > PCA 1019 get-ready-piedmont

—- Emergency Supply Kit —-

To assemble your kit, store items in airtight plastic bags and put your entire disaster supplies kit in one or two easy-to-carry containers such as plastic bins or a duffel bag.

A basic emergency supply kit could include the following recommended items:

- Water – one gallon of water per person per day for at least three days, for drinking and sanitation

- Food – at least a three-day supply of non-perishable food

- Battery-powered or hand crank radio and a NOAA Weather Radio with tone alert

- Flashlight

- First aid kit

- Extra batteries

- Whistle to signal for help

- Dust mask to help filter contaminated air and plastic sheeting and duct tape to shelter-in-place

- Moist towelettes, garbage bags and plastic ties for personal sanitation

- Wrench or pliers to turn off utilities

- Manual can opener for food

- Local maps

- Cell phone with chargers and a backup battery

- Download the Recommended Supplies List (PDF)

Additional Emergency Supplies

Consider adding the following items to your emergency supply kit based on your individual needs:

- Prescription medications

- Non-prescription medications such as pain relievers, anti-diarrhea medication, antacids or laxatives

- Glasses and contact lense solution

- Infant formula, bottles, diapers, wipes, diaper rash cream

- Pet food and extra water for your pet

- Cash or traveler’s checks

- Important family documents such as copies of insurance policies, identification and bank account records saved electronically or in a waterproof, portable container

- Sleeping bag or warm blanket for each person

- Complete change of clothing appropriate for your climate and sturdy shoes

- Household chlorine bleach and medicine dropper to disinfect water

- Fire extinguisher

- Matches in a waterproof container

- Feminine supplies and personal hygiene items

- Mess kits, paper cups, plates, paper towels and plastic utensils

- Paper and pencil

-

Books, games, puzzles or other activities for children

PG&E Public Safety Power Shutoff to begin at Noon on Wednesday, October 9th

Parts of Piedmont To Be Affected

Pacific Gas and Electric Company has confirmed their intent to conduct a Public Safety Power Shutoff (PSPS) which will include portions of Piedmont as early as Wednesday, October 9th at 12:00 Noon and could last for up to 5 days. Other power outages may occur as a result of this wind event. All Piedmonters are advised to be prepared for power outages during this wind event, which may or may not be proactive Public Safety Power Shutoffs (PSPS).

Based upon information provided by PG&E it appears that all or portions on the following streets in Piedmont will most likely be included in this PSPS:

Blair Avenue

Blair Place,

Calvert Court

Cambrian Avenue

Cavanagh Court

Cavendish Lane

Crest Road

Croydon Circle

Estates Drive

Farragut Avenue

Glen Alpine Road

Hampton Road

Huntleigh Road

Indian Road

King Avenue

La Salle Avenue

Lexford Road

Marlborough Court

Sandringham Place

Sandringham Road

Sea View Avenue

Selborne Drive

Somerset Road

Sotelo Avenue

St. James Circle

St. James Drive

St. James Place

Trestle Glen Road

Tyson Circle

Valant Place

It is probable that electricity to all residences, businesses, schools, mobile phone towers, and public facilities in the affected area may be turned off. The City of Piedmont has no additional details as to whether individual homes or businesses will be affected by the PSPS. Piedmonters are among the up to 750,000 PG&E customers in 32 counties who will be affected by this event.

PG&E will attempt to alert affected customers through calls and texts messages just before power is shut off. They will also use their web site and social media channels to provide information and will keep local news and radio outlets informed and updated.

Residents and businesses who are enrolled in East Bay Community Energy will be affected by these Public Safety Power Shutoffs.

The City of Piedmont has plans in place to ensure that emergency services and public safety are maintained during a Public Safety Power Shutoff, but affected residents will need to be self-reliant for a period of time.

For more information on how to be prepared for emergencies, please see the Public Safety Committee’s Get Ready, Piedmont brochure.

>PCA 1019 get-ready-piedmont

During a Public Safety Power Shutoff, please call 911 to report any emergencies which occur. Please hold non-emergency calls until after the after the PSPS event has concluded.

Piedmont voters are called to a special election exclusively for Piedmont Schools on November 5, 2019. Some confusion has arisen as to the amount of the Measure G and H taxes and the relationship between various current and proposed tax measures.

Measure G, essentially a continuation tax, preempts existing school parcel tax, Measure A, which is scheduled to expire in 2021. Every property owner in Piedmont will pay a base rate of $2,763 per parcel per year if Measure G is approved.

Measure H is a new additional school parcel tax increasing the school parcel taxes property owners will pay. If Measure H, if approved by voters, will require property owners to pay an additional tax of $0.25 per square foot of habitable space on their parcel.

Example:

$2,763 = Base amount for approval of Measure G.

If Measure G and H are approved, a homeowner with 2,000 square footage of habitable space will pay $2,763 base tax plus 2,000 multiplied by 25 cents equaling $500 for a total of $3,263, rather than the current yearly base rate of $2,763 per parcel.

MEASURE G IS ESSENTIALLY A RENEWAL OF THE CURRENT SCHOOL PARCEL TAX

The Piedmont Board of Education is asking Piedmont voters to support (“Measure G”) on November 5, 2019 the renewal of its existing parcel tax to maintain current programs starting at the $2,763 rate with a potential 2% annual increase. In a separate measure (“Measure H”) voters are asked for an additional amount ($0.25 per square foot of habitable square footage / building improvements – on a parcel.)

Measure G is a continuation tax without a tax base increase. Measure G, if approved, will have an 8-year “duration” of the tax. The tax can be increased by 2% per year. Approving Measure G will provide $10.6 million in revenues to the Piedmont Unified School District.

MEASURE H IS A NEW ADDITIONAL TAX BASED ON THE HABITABLE SQUARE FOOTAGE OF BUILDING IMPROVEMENTS ON A PARCEL.

The second ballot measure (Measure H) is new and an additional tax to be applied to all Piedmont parcels. Measure H would be set at a flat rate of $0.25 per square foot of building improvements, square footage of a home (Improvements are existing improvements of the habitable square footage space of all buildings and homes on a parcel). Measure H would have an 8-year duration. Passage of Measure H would result in an additional $2.6 million to the Piedmont schools. All homeowners and business will pay for this additional tax if approved. Homes with more square footage of habitable space will pay more than smaller homes and buildings.

If both G and H Measures pass, rates will vary tremendously per parcel on the additional tax with the largest square footage homeowners paying up to $6,568 per year.

Both Measures G and H would raise $13.3 million.

Registered Piedmont voters have received a Voter Information Guide in the mail that details the election. The election is a stand alone special election exclusively related to the Piedmont Unified School District. The current parcel tax does not expire until June 2021. The two proposals, if approved, will take effect in 2020.

Residents have been canvassed by volunteer supporters to determine individuals voting preferences – yes or no. Individuals stating they are in support of the ballot measures can expect reminders to vote in the November 5, 2019 Election. Those who have voiced opposition or no preference to the ballot measures should not expect to receive a reminder to vote on the November 5 ballot measures.

Explanations and the rationale for supporting the school parcel tax proposals can be found in the Voter Information Guide. No argument was filed against the measures in the Voter Information Guide.

Voters have been asking:

1.The Voter Information Guide is unclear about whether or not PERMANENT “Vote by Mail” voters need to re-apply for their mail ballot.

Answer: It is our understanding that those previously receiving their ballot in the mail will continue to receive their ballot without reapplying. If for any reason, a voter does not timely receive their ballot in the mail, the voter can vote in person at their polling location listed on the back of the Voter Information Guide or any polling location.

“Vote by mail allows voters to cast a ballot without going to a polling place. If a registered voter has applied to vote by mail, the Registrar’s office mails a ballot to the registered address of the voter beginning 29 days before an election. The voter votes the ballot and returns it to the election office by mail. The voter can also return it in person to the office or to any polling place on Election Day to be counted. Any voter can apply to vote by mail permanently in every election.” Registrar of Voters

2. Are the school parcel taxes deductible on Federal income taxes?

Answer: Deduction of state and local taxes are each year limited to a maximum deduction of $10,000 per single or married couple on Federal income tax returns. Many Piedmonters will likely not be able to deduct the school parcel tax in additional to their state income taxes.

3. What happens if the school parcel tax measures are not approved by Piedmont voters?

Answer: To be approved, each ballot measure requires approval by 2/3 rds or 66 2/3rds of the voters voting on the measures. If voters approve Measure G, but not Measure H at the November 5 Election, the School Board will likely accept that voters did not want additional funding beyond the base amount of Measure G. However, if both measures are rejected by voters, it is assumed that the School Board will return with a different measure to achieve voter support prior to the 2021 expiration of the current school parcel tax, Measure A.

4. Is there an exemption for senior homeowners ?

Answer: No. The School Board was informed that many other school districts have an exemption or tax reduction for senior homeowner taxpayers; however, in calculating the result of reducing or eliminating the tax for seniors and given the significant number of seniors residing in Piedmont, a determination was made that insufficient funds would be derived from the tax to produce adequate funds to support School District needs. Additionally, the School Board noted that property values related to excellent schools benefited all Piedmont property owners whether seniors or not.

5. What percentage of the school population does not reside in Piedmont?

Answer: The number varies but all city and school employees are allowed to send their children to the Piedmont schools. Additionally, the Piedmont Millennium High School has a significant number of students residing outside of Piedmont. A recent need for more students to maintain the budgeted amount derived from the California state contribution of approximately $8,500 resulted in an invitation to residents’ grandchildren and others from outside of Piedmont to fill specific slots in certain grades. About 18 additional non-resident students were added to the student population for the 2019-2020 school year.

6. Does the School District need Measure H to balance their budget?

Answer: Measure H provides funding beyond the basic budgetary needs of the District. Measure H was proposed as a way to increase funding for school teachers and other purposes identified by the School Board.

7. Where can I return my “vote by mail” ballot?

Answer: An Alameda County Ballot Box where voters can drop their no postage ballot will be at the corner of Highland and Highland Way, next to the mailboxes, near Wells Fargo Bank in central Piedmont. Voters can also mail their ballot as stated on their envelope. When mailed, the envelope requires no postal stamps. Voters can also turn in their ballot to officials at their regular voting location noted on the back of their Voter Information Guide or any polling location.

8. D0 City of Piedmont municipal parcel taxes go to the schools?

Answer: No. The School District and the City of Piedmont have separate revenues, separate budgets, and separate governance. Piedmont property owners pay separately for the schools and the city The funds are not commingled. Property owners can see the distinct taxation for the schools and the city on their recent Alameda County property tax statement.

Editors Note: PCA does not support or oppose any ballot measures.

Updated 10/14/2019

PG&E Announces Possible Public Safety Power Shutoff Affecting Piedmont

Pacific Gas and Electric Company has announced that they may conduct a Public Safety Power Shutoff (PSPS) which could include Piedmont as early as Wednesday, October 9, 2019 and could last for several days.

Should this occur, it means that electricity to all residences, businesses, schools, mobile phone towers, and public facilities in the affected area may be turned off. This Public Safety Power Shutoff event may affect PG&E Customers in 29 counties.

The City of Piedmont will provide additional information when it becomes available.

PG&E proactively turns off electrical lines in the interest of safety to help reduce the likelihood of an ignition when extreme fire danger conditions are forecasted.

To be ready for a Public Safety Power Shutoff event, please take the following steps.

1. Make sure PG&E has your current contact information. Update your contact information with PG&E online or call (866) 743-6589.

2. Check and update your emergency kit and supplies (include hard copies of critical information and life-saving prescriptions).

3. Identify a place you can go to cool off, if necessary

4. Have a back-up charging system for cell phones and keep devices fully charged at all times.

5. Learn how to manually open your garage door.

6. Keep cash on hand (credit/debit stations, and ATMs may be without power).

7. Learn more about Public Safety Power Shutoffs in your area and work with your neighbors to make sure everyone is ready.

8. Stay informed during disasters and sign up for alerts. PG&E will attempt to reach customers through calls, texts and emails using the contact information they have on file for your account. PG&E will also use their web site and social media channels, and we will keep local news and radio outlets informed and updated.

Residents and businesses who are enrolled in East Bay Community Energy will be affected by these Public Safety Power Shutoffs.

The City of Piedmont has plans in place to ensure that emergency services are maintained during a Public Safety Power Shutoff, but affected residents will need to be self-reliant for a period of time.

For more information on how to be prepared for emergencies, please see the Public Safety Committee’s Get Ready, Piedmont brochure.

During a Public Safety Power Shutoff, please call 911 to report any emergencies which occur.

The City of Piedmont has implemented plans to ensure that emergency services are maintained during a Public Safety Power Shutoff. Please hold non-emergency calls until after the after the PSPS event has concluded. Attached to this release are information documents from PG&E and East Bay MUD regarding Public Safety Power Shutoffs.

Piedmont Contact: John O. Tulloch -October 7, 2019 – (510) 420-3040

PCA 1019 Public-Safety-Power-Shutoff-Fact-Sheet

PCA 1019 water_Fact_Sheet_-_071019-FINAL-web

Updated street sweeping schedule –

http://www.ci.piedmont.ca.us/UserFiles/Servers/Server_13659739/File/Government/Departments/Public%20Works/street_sweeping.pdf

The current City of Piedmont Parcel Tax expires on June 30, 2021. The Budget Advisory and Financial Planning Committee recommended continuation of the Parcel Tax at its current rate, but believes additional funding will be needed either by increasing the current Parcel Tax rate or supplementing with an increase in other revenue sources, such as the Transfer Tax. Agenda item 4

The unassigned balance of the General Fund at June 30, 2019 is estimated to be $6.4 million and a transfer of $1.1 million from the General Fund to the Facilities Maintenance Fund is recommended by Michael Szczech, Finance Director. Agenda item 6

The Piedmont City Council meeting will be on Monday, October 7 at 7:30 pm in the Council Chambers at City Hall, 120 Vista Avenue. The meeting will be broadcast live on the City website and Cable Channel 27. Recordings of the meeting are available on the City website.

Consent Calendar, followed by the Regular Agenda

- Approval of Council Meeting Minutes for 08/19/19

- Receipt of a Report on the City’s Investment Portfolio

- Approval of a Resolution Directing the Police & Fire Pension Board to Provide Oversight Over Additional Investment Portfolios

- Consideration of a Report from the Budget Advisory and Financial Planning Committee Regarding the Municipal Services Special Tax and Possible Direction to Staff on Next Steps 0320, 1030

- Consideration of FY 2018-19 Year-End Appropriations, Adjustments, and Carryforwards 0165

- Consideration of FY 2018-19 Year End Fund Transfers

Budget Advisory and Financial Planning Committee Report

—–Staff Reports—-

Year End Fund Transfers

Year-End Appropriations, Adjustments, and Carryforwards Report

All agenda reports are available on the City of Piedmont website.

Oct 4, 2019

Piedmont Recreation Pickleball Subcommittee

c/o Erin Rivera, City of Piedmont

Re: Oct. 7, 2019 Hearing

Dear Chairman Roland and Commissioners McCarthy and Dorman,

- We have 166 members on the Piedmont Pickleball Group. Many days now see three and four courts going full blast with more on the weekends. The model of experienced players stopping play to teach beginners is no longer viable as most of us simply want to play. We have initiated a volunteer introductory class every Saturday morning; Les Ellis has generously offered his time and expertise. We are starting to attract experienced out of town players. We have started family courts on the weekends. We are in the process of designating recreational and competitive courts; this insures an enjoyable game for all levels. Staff is in the process of arranging professional clinics; kindly encourage this.

- I urge that the Linda and Hampton hours be made permanent; complaints from neighbors and tennis players are nonexistent. I request the hours at Linda be extended a modest half hour to 1pm. This will not negatively affect tennis as there are no tennis players waiting to play at Linda at this time. Hampton at 3pm has tennis players waiting and we have informally accommodated them earlier if we are not using both courts.

- The overly light brown Hampton pickleball lines on the tan surface are difficult and the two courts next to the baseball field become effectively unusable as shadows obscure the baselines (see two photos). Darker lines should be installed. Additionally permanent net placement marks are needed at Linda and Hampton. While usable, the Linda pickleball lines could be a bit darker.

- The City and private donations funded most of the re-asphalting of the PMS courts with the intent to transform the deteriorated PUSD courts into a multi-use community sports asset with pickleball being the primary addition. A reasonable person assumes the District would have a conversation with the City and an integrated stripping plan would be enacted; this was not done. The District arbitrarily striped for badminton without integrating pickleball lines. The District striping is appropriate for parking lots and not sports activities. The Badminton World Federation Handbook II 2014/15 Section 1A states badminton court striping is 40mm / 1.6” (see Badminton World Federation Sec 4.1 p1 attached). PUSD striped their PMS badminton lines twice as wide at 83mm or 3.25” (see att.). The paint used by the District has an unneeded three dimensionality to it and the lines are not sharp.I am disappointed in the District’s unilateral action. If a redo is possible, the four pickleball courts on the first two badminton venues can be restriped about two feet closer to each other so the existing basketball poles are less of an obstruction; they are in issue now if balls are hit near them.

- While the Linda redo is likely years off, four dedicated pickleball courts accommodating 16 players can be placed there rather than the two tennis courts accommodating 2 to 4 players. Another advantage of dedicated pickleball over tennis is that about 35% of space earmarked for tennis can be used for other uses such as a larger tot lot or other sports facilities.

Sincerely,

Rick Schiller

Piedmont, CA

cc: Jennifer Cavenaugh

Read the full letter and see photos by clicking below:

PCA 2019-10-07 RSschiller Rec subcomm