Where Has All the Money Gone?

Piedmont General Fund no longer has annual surpluses –

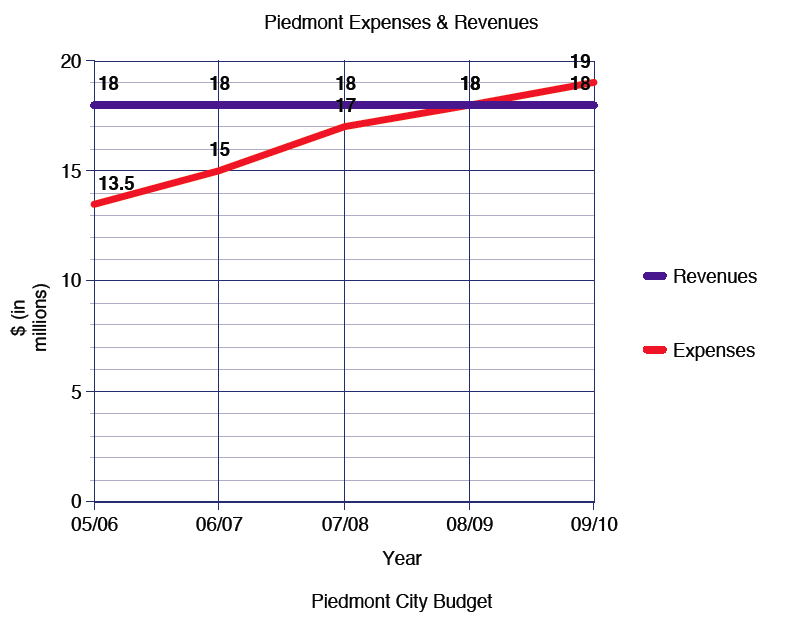

A few short years ago, Piedmont enjoyed a $4.5 million annual operating budget surplus. With expenses of $13.5 million and revenues of $18 million, the City’s expenses represented only 75% of revenues in FY 05-06. It enjoyed a surplus that was 25% of its budget. City monies, not just private funds, were allocated annually to capital improvement projects such as the purchase of 801 Magnolia Avenue, installing play fields, and more.

This year expenses equal revenues. Piedmont had $20 million in revenues compared to $20 million in expenses for FY 11-12.

How did expenses become 100% of revenues? Where did Piedmont’s large surpluses go? Why have City expenses almost doubled, while revenues remain fairly flat?

A historical look at the budget reveals a rapid escalation of costs after 2005/06. While operating expense escalated to $19 million, revenues remained flat at $18 million. This cost escalation began long before 2008 and 2009 financial problems imposed by general economic conditions. (Also, the financial crisis can be attributed with slowing revenue increases, but not increasing costs.) Where did all the money go?

The 2011 Municipal Tax Review Committee (MTRC) points to a massive increase in employee fringe benefits from 25-30% of salary up to 53% of salary.

The City increased retirement benefits by 50% in 2004 (public safety) and in 2008 (other groups).

While one-time expenses, such as $2.4 million spent on undergrounding and the Crest Road collapse, are known to have depleted the City’s General Fund and CIP reserves, the larger and longer term cost impact of escalating employee benefits is less recognized. Its impact is buried deep in the budget numbers, filtering through every department budget every year; this cost never shows itself as a single line item. While the hemorrhage of red caused by undergrounding has been staunched, the chronic problem of escalating fringe benefit costs remains.

The Sewer Fund

Another issue is the depletion of the Sewer Fund. The taxpayers voted to triple the Sewer Parcel Tax in the year 2000, from $700,000 to $2 million per year, with an annual cost of living adjustment. The specific purpose of this tax, as explained to voters, was to renovate the City’s sewer mains. Now, we are advised that the Sewer Fund does not have enough funds to finish the last of its 7 phases of sewer renovation work. Why?

Why is $2 million per year in revenues, in perpetuity, not sufficient to cover the City’s projected cost of $10.5 million for the remaining work? The primary reasons are:

- an annual charge of $1 million to the Sewer Fund by the Public Works Department for maintenance, which includes storm drain and “sewer-related” maintenance, as well as sewer maintenance.

- large expenditures for general sewer repairs during the last 5-6 years, e.g. $2 million in just 2 years from 2007 to 2009.

(An item not on this list is new EPA monitoring/reporting costs of $164,000 per year, a relatively minor charge to the Sewer Fund compared to repair and maintenance charges, which have been running up to a million dollars per year.)

The Future

A new committee, the Budget Advisory and Financial Planning Committee (BAFPC), has been appointed by the City Council to review City finances and prepare 5-year projections, helping the City Council to better grasp the future impact of its decisions. The BAFPC will be issuing recommendations to address escalating fringe benefits, a depleted Sewer Fund and other financial issues and areas of future risk.

As a member of the MTRC, a majority of the committee noted the increasing costs of benefits were problematic and the City needed to address these costs by capping the amount spent by the City (as done by the School Board)so that employees pay a reasonable share. The City also pays the total pension costs ( now a small portion of the increase is paid by employees). This expense is not controlled by the City. What PERS requires, the City must pay.